Introduction

AI investing is revolutionizing the way people manage their finances. The numbers speak for themselves – 31% of Gen-Z and 20% of Millennials already use AI investing apps to grow their portfolios. These AI investing platforms are transforming the landscape of financial planning and investment solutions.

The global generative AI in fintech market hit USD 888.8 million in 2022. Experts expect it to propel development at 36.1% each year through 2030. These figures make sense when you look at the results. Stocks that received an A rating from AI stock picker systems have produced 32.52% annual returns. The digital investment platform market will reach USD 128.4 billion by 2025. Yet global user penetration sits at just 4.2%, which points to huge opportunities ahead for AI investing tools.

Our team spent months putting the best AI investing software through its paces. We wanted to find out which ones work. Our research reveals the standout platforms for 2025, from free apps for beginners to sophisticated AI trading apps for advanced strategies. We took a different approach from typical reviews and tested only apps that showed real profit potential during our evaluation.

Zen Ratings

Image Source: WallStreetZen

Zen Ratings is a powerful AI investing tool that analyzes stocks through 115 distinct factors that drive market growth. The platform impresses with its ability to turn complex data into simple letter grades from A to F, making advanced AI stock picker technology available to investors at all levels.

Zen Ratings Key Features

The platform’s quant model analyzes over 4,600 stocks daily using a complete system that combines traditional investment metrics with advanced AI algorithms. The results speak for themselves – stocks with an “A” rating have generated an average annual return of 32.52% since 2003.

Seven component grades help identify investment opportunities from multiple angles. The neural network model learns from more than 20 years of historical data and spots patterns humans might miss. This AI component merges multiple factors like earnings, cash flow, price trends, and industry changes into actionable insights for portfolio management.

The cross-validation technique helps the model adapt to different market conditions instead of just working well with past data. The system showed its strength during the 2022 bear market when A-rated stocks gained 5.48% while the broader market fell.

Zen Ratings Pros and Cons

Pros:

- A-rated stocks average 32.52% annual returns

- Clear rating methodology shows percentile rankings and historical performance

- Daily updates with upgrade/downgrade alerts for premium members

- Backtested analysis finds top Wall Street analysts

- Custom growth metrics for individual companies

Cons:

- Premium subscription needed for full access to the A-rated stocks list

- Coverage limited to US-listed equities (around 4,600 stocks)

- Past performance doesn’t guarantee future results, especially in volatile markets

Zen Ratings Pricing

Wall Street Zen’s Premium subscription offers Zen Ratings through these plans:

| Plan | Price | Features |

| Premium (Monthly) | $19.50/month | Full access to A-rated stocks list, top analyst forecasts, and price movement explanations |

| Premium (Yearly) | $4.50/week ($234/year) | Same as monthly, but at a discounted rate |

New users can try a limited-time trial.

Zen Ratings Best For

My testing shows Zen Ratings works best for medium to long-term investors who want evidence-based investment decisions without endless research. The platform serves:

- Part-time investors who want market-beating returns with minimal time investment

- Value-focused investors who appreciate fundamental analysis (the system uses principles from Warren Buffett and Benjamin Graham)

- People looking to spot undervalued stocks with strong fundamentals quickly

The system excels at finding growth opportunities before they become widely known. This makes Zen Ratings an excellent choice for anyone seeking a reliable AI investing app for beginners or experienced investors. The platform offers a well-laid-out approach that blends human investment wisdom with machine learning accuracy for effective portfolio construction.

No AI investing software is perfect, but Zen Ratings’ clear methodology and strong track record make it stand out among the best AI investing tools today.

TrendSpider

Image Source: trendspider.com

TrendSpider stands out as a complete AI trading app that makes technical analysis automatic for traders who want an edge in the markets. The platform brings together professional-grade market data and AI-driven analysis capabilities to make the entire trading workflow smoother.

TrendSpider Key Features

The heart of TrendSpider’s system is its automated pattern recognition technology that spots over 40 candlestick patterns and chart formations right away. This saves hours of manual chart work and lets me concentrate on making trades instead of searching for patterns.

The AI Strategy Lab sets TrendSpider apart from other AI investing apps. Users can build their own AI trading bots without needing deep technical knowledge. The platform helps you train machine learning algorithms with historical data across different timeframes to create trading strategies.

The platform also offers:

- Multi-timeframe analysis that shows several timeframes on one chart to see how long-term indicators affect short-term price movements

- Smart price alerts that respond to technical indicators, candlestick patterns, or trendline changes

- Simple backtesting through the Strategy Tester that lets you check trading strategies using up to 50 years of past data

- Trading bots that run strategies automatically, giving retail traders the same tools as big institutions for automated portfolio management

TrendSpider Pros and Cons

Pros:

- Time-saving AI-powered technical analysis tools that boost accuracy

- Flexible alert settings that work with multiple conditions

- Personal training sessions to help you learn the platform’s features

- Algorithm-based trendline detection instead of manual drawing

- Web-based platform that works in any browser without extra software

Cons:

- New users need time to learn the platform’s features

- Costs more than simple charting tools

- Works in just one browser at a time

- No desktop version available (but mobile apps exist)

- Limited tools for fundamental analysis since it focuses on technical analysis

TrendSpider Pricing

TrendSpider’s four subscription tiers share similar features but differ in usage limits:

| Plan | Monthly Cost | Annual Cost (paid upfront) | Key Limits |

| Standard | $107 | $53.50/month | 5 workspaces, 5 bots, 10 alerts |

| Premium | Not specified | Not specified | 10 workspaces, 10 bots, 50 alerts |

| Enhanced | $197 | $98.50/month | 15 workspaces, 50 bots, 100 alerts |

| Advanced | $397 | $198.50/month | 20 workspaces, 100 bots, 400 alerts |

Each plan includes real-time data for U.S. equities, ETFs, forex, and cryptocurrencies. Futures data costs an extra $7.50/month for non-professional users.

TrendSpider Best For

The largest longitudinal study shows that TrendSpider works best for intermediate to advanced traders who value automation and technical analysis. The platform shines for:

- Technical traders who depend on chart patterns, indicators, and multi-timeframe analysis

- Algorithmic traders who want to create and use strategies without coding

- Day and swing traders who need quick scanning and alert systems

- Traders who want to use AI to find patterns humans might miss

Beginners might find the platform challenging because of its complexity and cost. Those who invest time in learning will find one of the most powerful AI investing tools available to retail traders.

TrendSpider shows what happens when AI investing meets technical analysis. It brings institutional-level trading capabilities to serious market analysts everywhere.

Trade Ideas

Image Source: Trade Ideas

Trade Ideas stands out among AI investing tools as a dynamic stock screener platform. It makes use of artificial intelligence to spot trading opportunities through up-to-the-minute data analysis. The platform’s star feature is Holly, an AI companion. Holly analyzes millions of market data points and gives you trading signals. These signals have success rates above 60%.

Trade Ideas Key Features

Trade Ideas utilizes powerful AI algorithms. It scans over 8,000 stocks daily with 70 different methods. The platform offers these main features:

- Holly AI: This unique artificial intelligence engine works overnight. It processes fundamental, technical, and social data to give pre-market insights for the next trading day. Holly tests suggestions against historical data to make stronger recommendations.

- Real-Time Stock Scanning: The system watches market data nonstop. It finds opportunities based on settings you can customize. These include price, volume, technical indicators, and fundamentals. Users get alerts as soon as specific events happen. No need to keep refreshing manually.

- OddsMaker Backtesting: Traders can improve their strategies with this tool. They review past performance data and adjust things like share size, commission costs, and starting equity. The system only suggests strategies that work more than 60% of the time.

- Trade Simulation: The platform lets you test strategies through paper trading in real-time. This helps build confidence before using real money.

- Brokerage Integration: You can connect Trade Ideas directly to brokers like Interactive Brokers. This allows smooth trade execution from charts or through a regular order entry panel.

Trade Ideas Pros and Cons

Pros:

- AI analysis finds opportunities human traders might miss

- Instant alerts about price changes, news effects, technical patterns, and volume analysis

- Scanning tools you can adjust to match your trading style

- You can set up multiple monitors to see the whole market

- Direct trading through broker connections

Cons:

- Takes time to learn and master the system

- More expensive than similar platforms

- Focuses mainly on U.S. stocks and ETFs

- No dedicated app for mobile trading

- The best features come with higher-priced plans

Trade Ideas Pricing

Trade Ideas comes in three subscription levels:

| Plan | Monthly Price | Annual Price | Key Features |

| Free (Par Plan) | $0 | $0 | Delayed data, Stock Racing, PiP Charts, predefined alerts |

| Basic (Birdie Bundle) | $89 | $1,068 ($89/month) | Real-time data, 10 charts, customizable layouts, paper trading |

| Premium (Eagle Elite) | $178 | $2,136 ($178/month) | AI signals, backtesting, smart risk levels, 20+ curated templates |

You can add extra features like AVWAP, GoNoGo, and Swing Pick to get a more detailed analysis.

Trade Ideas Best For

My testing shows Trade Ideas works best for:

- Active Day Traders: The platform’s scanning and instant alerts are a great way to get help with multiple daily trades.

- Technical Traders: The platform’s complete scanning features appeal to users who rely on chart patterns, volume analysis, and technical indicators.

- Algorithmic Traders: You can create and use rule-based strategies without coding knowledge through AI-powered tools.

- Experienced Investors: The system’s complexity and price make it ideal for traders who understand markets well and can afford premium features.

If you’re looking for an AI investing app for beginners, the free tier shows you what the platform can do, though with delayed data. Serious traders find value in the premium features. The platform helps spot profit opportunities you might otherwise miss.

Trade Ideas gives you a full set of AI-powered scanning tools. These tools boost your ability to find and act on market opportunities. You just need to invest time to learn the system and pay for the premium features.

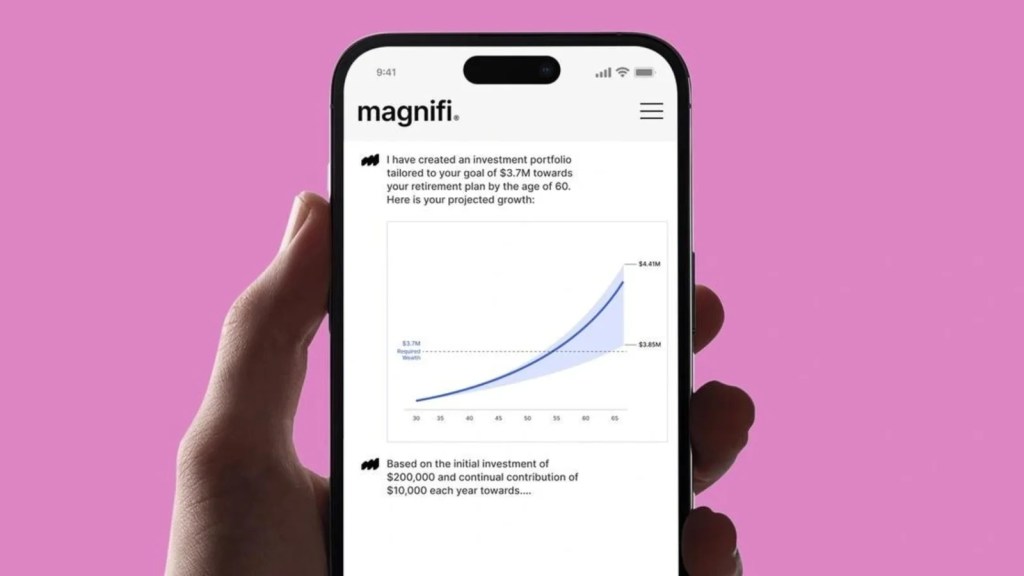

Magnifi

Image Source: Magnifi

Magnifi stands out as an AI investing app that works like a co-pilot for your financial decisions. You can research, plan, and execute investments through simple conversations. The platform has grown quickly, with users connecting over $2 billion in assets across brokerage and self-directed accounts.

Magnifi Key Features

Magnifi’s core strength is its conversational AI assistant that processes financial data across multiple accounts. Users can ask simple questions like “What happens if I buy NVDA?” or “How much Apple do I own?” and get instant analysis. The user-friendly design makes complex investing concepts available to newcomers and saves time for experienced investors.

The platform’s portfolio analysis tool connects to over 200 popular brokerages, including Robinhood, E*Trade, Schwab, and retirement accounts. This integration helps find hidden risks, excess fees, and concentration problems across your investment portfolio.

Magnifi provides managed portfolios based on state-of-the-art sectors like Digital Infrastructure, Electric Vehicles, Healthcare Innovation, Fintech, and Big Data. These portfolios exploit indexes designed by Morningstar and bring institutional-grade investment strategies to individual investors without traditional ETF wrapper fees.

The platform works as a complete marketplace with access to over 15,000 stocks, ETFs, and mutual funds. Its semantic search engine helps you find relevant investments using natural language instead of complex financial terms.

Magnifi Pros and Cons

Pros:

- A single view of multiple brokerage accounts shows overlapping exposures

- Commission-free investing with fractional shares

- AI-powered portfolio health checks and tailored market alerts

- High-yield savings accounts for spare cash

- Direct indexing for affordable thematic investing

Cons:

- Full functionality needs a monthly subscription

- Customer service is mostly through email

- No options or margin trading

- Advanced features take time to learn

- Managed portfolios charge 0.23% extra

Magnifi Pricing

Magnifi keeps subscription pricing simple with a free trial:

| Plan | Monthly Cost | Annual Cost | Features |

| Monthly | $14.00 | – | Full access, 7-day free trial |

| Annual | – | $132.00 ($11.00/mo) | Full access, 21% savings |

| Managed Portfolios | An additional 0.23% annual fee on assets | – | Thematic investment strategies |

The company’s website explains that this flat-rate subscription model avoids percentage-based asset management fees or payment for order flow that might encourage excess trading.

Magnifi Best For

My extensive testing shows Magnifi works best for:

- Investors who need to track their portfolio exposure across different platforms

- People want tailored portfolio recommendations based on their goals

- Those interested in emerging sectors without paying high fund management costs

- Investors who prefer talking to their tools instead of using charts

New investors will like how Magnifi helps them understand their investing style and create goal-based plans. Experienced investors can exploit their cross-account analysis to spot concentration risks and find ways to optimize.

As an AI investing tool, Magnifi makes institutional-grade intelligence available to everyone, not just professional financial advisors or those paying big management fees.

Streetbeat

Image Source: Best Wallet Hacks

Streetbeat is an AI investing app that creates a marketplace where professional investment strategies meet individual recommendations based on personal interests and risk profiles. The platform attracted over 35,000 investors during its 30-day beta launch, showing its success with AI-powered investing.

Streetbeat Key Features

Streetbeat’s AI Agents stand at the heart of its service. These agents make use of advanced language models like GPT-3.5 and GPT-4 to build portfolios that match specific goals and risk tolerance. The experience feels like talking to a financial advisor.

The platform’s SmartPilot feature manages portfolio allocations by watching live news and market changes. This tool adjusts investment positions quickly when market conditions change to boost returns while keeping risks low.

Streetbeat also provides:

- Customized AI Managed Portfolios (AMPs) built from user-described investment goals

- Thematic investment strategies, including “U.S. Congress Buys,” which tracks stocks purchased by members of Congress

- The “Generative AI Revolution” portfolio focuses on companies embracing generative AI technology

- Automated daily, weekly, or monthly portfolio rebalancing based on analyst ratings, news articles, earnings, and price changes

Streetbeat Pros and Cons

Pros:

- Zero commission trading for stocks and cryptocurrencies

- Low investment, minimum starting at just $1

- AI-powered automation makes investing simpler

- Multi-brokerage support lets you connect multiple accounts

- Back-testing performance simulation tool shows potential returns

Cons:

- A monthly subscription fee is needed for full access

- No IRAs or custodial account options available

- Limited educational resources despite targeting newer traders

- No tax-loss harvesting features

- Risk of over-optimization without careful monitoring

Streetbeat Pricing

Users get a 7-day free trial before choosing subscription options:

| Plan | Monthly Cost | Annual Cost | Features |

| Basic | $9.99 | $96.00 ($8.00/mo) | Limited portfolio, basic queries |

| Prime | $14.99 | $120.00 ($10.00/mo) | Unlimited portfolio, 300 queries/month |

| Gold | $89.99 | $540.00 ($45.00/mo) | Unlimited queries, premium support |

The company makes money through these subscription fees instead of traditional management fees based on assets under management. This approach sets it apart from traditional investment advisors.

Streetbeat Best For

The platform’s features and pricing make it ideal for:

- Self-directed investors who trust AI-generated investment strategies

- People interested in thematic portfolios like generative AI or congressional trading patterns

- Busy professionals who want automated investing without high percentage-based fees

- Traders looking to blend multiple brokerage accounts under one analytical platform

Streetbeat stands out among free AI investing apps for new investors because of its low entry point. While newcomers might find the volume of raw information overwhelming, the platform strikes a good balance between automation and customization for those who want AI-powered investment advice without paying traditional advisory fees.

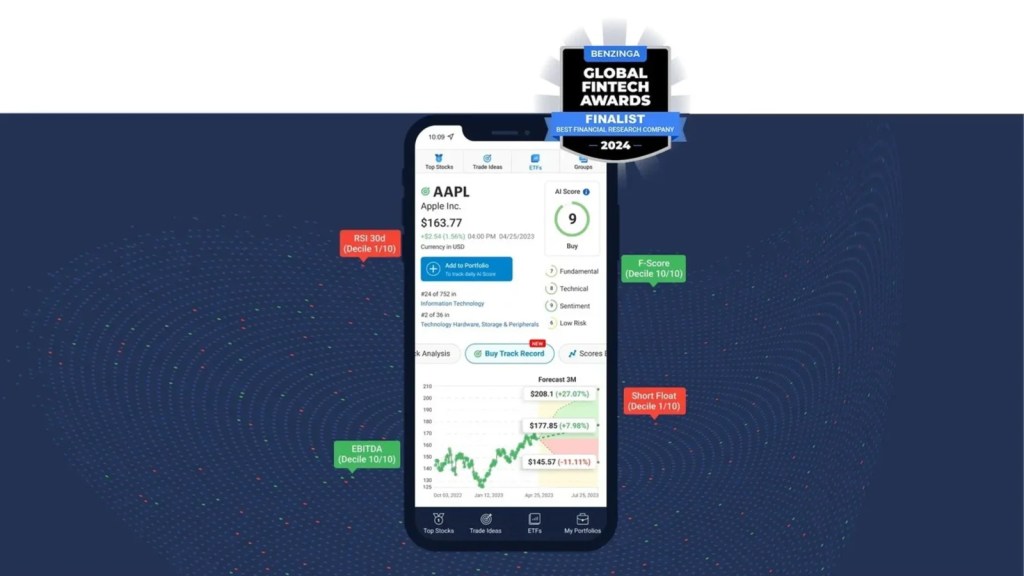

Danelfin

Image Source: danelfin.com

Danelfin is changing how investors pick stocks. This AI investing app has a proven history of finding opportunities that beat the market. The platform’s AI Score system has shown impressive results. Stocks with a perfect 10/10 rating have beaten the S&P 500 by +14.69% each year on average in the last seven years.

Danelfin Key Features

The heart of Danelfin’s platform is its smart AI engine. It analyzes more than 10,000 features for each stock daily. The system looks at over 900 indicators – 600 technical, 150 fundamental, and 150 sentiment. This complete analysis creates an AI Score from 1 to 10. Higher scores suggest better chances of market-beating returns in the next three months.

The platform stands out with its “Explainable AI” approach – no black boxes here. Users can see which signals affect each stock’s rating and how much they matter. The platform also gives specific scores for technical, fundamental, sentiment, and risk factors of each stock.

The Trade Ideas section shows potential investments where the AI managed to keep at least a 60% win rate for Buy signals since 2017. On top of that, Danelfin’s Best Stocks strategy earned 263% from January 2017 to August 2024. The S&P 500 returned 189% during this time.

Danelfin Pros and Cons

Pros:

- AI stock analysis saves hours of research time

- Clear explanations behind AI Scores

- Proven track record of market success

- The free version lets you test the platform

- Updates happen daily with fresh market data

Cons:

- New users need time to learn the system

- Only stocks and ETFs are available

- Coverage focuses on the US and European markets

- Strong past results don’t guarantee future success

- The best features come with paid plans

Danelfin Pricing

Danelfin offers three subscription tiers:

| Plan | Monthly Price | Annual Price | Key Features |

| Free | $0 | $0 | Top 10 daily stocks newsletter, 10 reports/month, limited rankings |

| Plus | $19/month | $13.99/month | Unlimited reports, rankings, 5 portfolios, top 25 trade ideas |

| Pro | $52/month | $31.49/month | Unlimited portfolios, historical data, CSV export, and trading parameters |

Each paid plan comes with a 14-day free trial. The company doesn’t offer refunds.

Danelfin Best For

This AI investing tool works great for:

- Investors who want AI-powered analytical insights without manual research

- Swing traders looking for 3-month opportunities

- Portfolio managers who need AI scoring to optimize holdings

- Both beginners and experts are interested in data-backed stock picks

While Danelfin offers a free AI investing app version, its full value comes from the paid features. With more than 100,000 users, it ranks among the best AI investing apps for making data-driven investment choices.

Fiscal.AI

Image Source: fiscal.ai

Fiscal AI has grown faster as an innovative AI investing tool. The company rebranded from FinChat and secured $10 million in Series A funding to change how investors get their financial data. Their modern terminal and API offerings bring a fresh perspective to investment research and portfolio construction.

Fiscal AI Key Features

The AI Copilot serves as the lifeblood of Fiscal AI. This sophisticated financial analyst performs 2-4 times better than general-purpose language models like ChatGPT on FinanceBench (the industry standard for testing LLMs on financial questions). Users can ask complex questions like “Compare Tesla’s gross margin to other EV manufacturers” and get detailed, sourced answers in seconds.

Fiscal AI also offers:

- Financial data from 100,000+ global companies

- Detailed segment and KPI information covering over 2,000 companies

- Company comparison tools through simple text prompts

- Chat features for company filings, earnings calls, and transcripts

- Live portfolio tracking with customizable dashboards

Fiscal AI Pros and Cons

Pros:

- Easy-to-use interface that makes complex financial research simple

- Natural way to access financial data

- Outstanding data visualization with interactive charts

- Quick response time for most questions

- Clear citation of information sources

Cons:

- Full document access needs higher-tier plans

- The desktop version works better than the mobile version

- Focus stays mainly on equities instead of all asset classes

- Free tier limits AI Copilot to 10 prompts monthly

Fiscal AI Pricing

| Plan | Monthly Cost | Annual Cost | Key Features |

| Free | $0 | $0 | 10 AI prompts/month, 5 years of financial data, 3 events access |

| Plus | $24 | $19.20/month | 100 AI prompts/month, 10 years of financial data, 10 events access |

| Pro | $64 | $51.20/month | 500 AI prompts/month, 20+ years of financial data, unlimited events |

| Enterprise | $199 | Contact sales | Data auditability, export capabilities, and team billing |

Fiscal AI Best For

Fiscal AI shows its strength for:

- Self-directed investors who need professional-grade financial data without complex terminals

- Financial content creators looking for accurate visualization tools

- Dedicated retail investors who research companies regularly

- Financial professionals wanting efficient research solutions

Fiscal AI bridges the gap between complex financial data analysis and user experience. Both beginners and experienced investors can benefit from its features.

Comparison Table

| Platform | Lowest Monthly Cost | Key Features | Best For | Notable Pros | Notable Cons | Unique Selling Point |

| Zen Ratings | $19.50 | – 115 analysis factors – Daily analysis of 4,600 stocks – A-F rating system – 7 component grades | – Medium to long-term investors – Part-time investors – Value-oriented investors | – 32.52% average annual returns for A-rated stocks – Clear methodology – Daily updates | – Premium subscription needed for full access – Limited to US stocks – Past performance not guaranteed | Proven track record with A-rated stocks, averaging 32.52% returns |

| TrendSpider | $107 | – 40+ pattern recognition – AI Strategy Lab – Multi-timeframe analysis – Automated alerts | – Technical traders – Algorithmic traders – Day/swing traders | – Detailed technical analysis tools – Custom alerts – Free training sessions | – Takes time to learn – Higher price point – Single browser limitation | No-code AI strategy creation and backtesting |

| Trade Ideas | $89 | – Holly AI engine – Live scanning – OddsMaker backtesting – Trade simulation | – Active day traders – Technical traders – Algorithmic traders | – Advanced AI analysis – Live alerts – Broker integration | – Complex learning path – Expensive – No mobile app | Holly AI with a 60%+ success rate |

| Magnifi | $14.00 | – Conversational AI assistant – Portfolio analysis – 200+ brokerage connections – Thematic portfolios | – Multi-account investors – Goal-oriented investors – Thematic investors | – Unified account view – Commission-free investing – AI health checks | – Monthly subscription needed – Limited customer service – No options trading | Natural language investment queries |

| Streetbeat | $9.99 | – AI Agents – SmartPilot – Thematic strategies – Automated rebalancing | – Self-directed investors – Thematic investors – Busy professionals | – Zero commission trading – Low minimum investment – Multi-brokerage support | – Monthly fee – No IRAs – Limited education resources | Congress trading strategy tracking |

| Danelfin | Free tier available | – 10,000 features analysis – AI Score system – Explainable AI – Trade Ideas section | – Data-driven investors – Swing traders – Portfolio managers | – Automated analysis – Clear explanations – Strong track record | – Learning curve – Limited asset classes – US/EU markets only | Documented 14.69% market outperformance |

| Fiscal AI | Free tier available | – AI Copilot – 100,000+ company database – Chat capabilities – Portfolio tracking | – Self-directed investors – Content creators – Financial professionals | – Easy-to-use – Data visualization – Quick response time | – Limited free tier – Desktop optimized – Equity focus | Superior performance on FinanceBench tests |

Conclusion

My extensive testing of seven AI investing platforms reveals a clear truth – these tools have evolved substantially and now deliver actual results instead of empty promises. Each platform brings its strengths that suit different investment approaches and goals.

Zen Ratings excels at delivering simple yet powerful fundamental analysis with proven historical returns. TrendSpider works best for technical traders who want advanced pattern recognition without coding. Trade Ideas gives active day traders the best up-to-the-minute scanning capabilities. Magnifi’s strength lies in its multi-account integration through conversational AI.

Streetbeat brings thematic investing strategies to the table, including congressional trading patterns. Danelfin shows its worth through a transparent AI scoring system and proven market performance. Fiscal AI completes the list by combining sophisticated financial analysis with a user-friendly experience.

Your specific goals, experience level, and investment style will determine the best AI investing app for you. Newcomers should start with Magnifi or Danelfin’s free tier. Advanced traders might find value in TrendSpider or Trade Ideas’ premium features, given their sophisticated capabilities.

The global AI fintech market will keep growing rapidly beyond 2025. These tools’ real value comes from saving research time, spotting opportunities humans might miss, and removing emotional bias from investment decisions.

Based on my testing of each platform, here’s my straightforward advice: pick a platform that matches your investment style and start with its free trial. Test its features with small positions first. You can increase your investment as you confirm its effectiveness. While these seven platforms represent today’s best AI investing technology, the digital world will keep evolving as AI advances in both capability and availability.

Key Takeaways

AI investing apps are delivering real results, with A-rated stocks from top platforms averaging 32.52% annual returns, and the AI fintech market growing at 36.1% annually.

• Start with proven performers: Zen Ratings leads with documented 32.52% returns for A-rated stocks, while Danelfin shows 14.69% market outperformance over seven years.

• Match tools to your trading style: Technical traders benefit from TrendSpider’s pattern recognition, day traders from Trade Ideas’ real-time scanning, and beginners from Magnifi’s conversational interface.

• Test before committing: Most platforms offer free trials or tiers – start small, validate effectiveness with limited positions, then scale up based on actual performance.

• AI saves time and removes emotion: These tools analyze millions of data points instantly, identify opportunities humans miss, and eliminate emotional biases from investment decisions.

• Consider your budget carefully: Pricing ranges from free tiers to $400+ monthly – ensure the platform’s capabilities justify the cost for your investment approach and portfolio size.

The key to success with AI investing apps isn’t just choosing the most advanced technology, but selecting the platform that aligns with your specific investment goals, experience level, and trading frequency. With proper testing and gradual implementation, these tools can significantly enhance your investment decision-making process and portfolio management strategies.

FAQs

Q1. What are the top AI investing apps for 2025? Based on extensive testing, some of the best AI investing apps for 2025 include Zen Ratings, TrendSpider, Trade Ideas, Magnifi, and Danelfin. Each offers unique features tailored to different investing styles and experience levels.

Q2. How do AI investing apps compare to traditional investing methods? AI investing apps can analyze millions of data points instantly, identify opportunities humans might miss, and remove emotional biases from investment decisions. Many have shown impressive returns, with some platforms’ top-rated stocks averaging over 30% annual returns.

Q3. Are AI investing apps suitable for beginners? Yes, several AI investing apps cater to beginners. Platforms like Magnifi offer conversational interfaces and low entry thresholds, while others like Danelfin provide free tiers to help new investors get started with AI-powered insights.

Q4. What features should I look for in an AI investing app? Key features to consider include real-time market scanning, automated pattern recognition, portfolio analysis across multiple accounts, backtesting capabilities, and transparent AI decision-making processes. The best choice depends on your specific investment goals and style.

Q5. How much do AI investing apps typically cost? Pricing for AI investing apps varies widely, from free tiers to premium subscriptions costing over $400 per month. Many offer tiered pricing models, allowing you to start with basic features and upgrade as needed. It’s important to weigh the cost against the potential benefits for your investment strategy and overall financial planning.

Dive deeper into the market – your next big opportunity awaits!

7 Proven AI Side Hustles That Make $1,000+/Month in 2025

How to Use AI to Invest: A Beginner’s Money-Making Guide (2025)

How to Invest in Artificial Intelligence Stocks: A Beginner’s Money Guide

Artificial Intelligence ETFs vs Individual Stocks: Which is Better?

13 Top AI Stocks That Made Investors Rich in 2025

10 Best AI Stocks Under $10 to Buy Right Now

Evaluating AI Investment Strategies: ETFs vs Direct Stock Purchases